Don’t worry if you’ve exceeded the annual Social Security earnings limit, or think you might.

I know from experience that returning the money to Social Security is painless and efficient. In the following text, I will explain how it works. But first, let me give you some background information.

Working Part-Time at 62 and Collecting Benefits

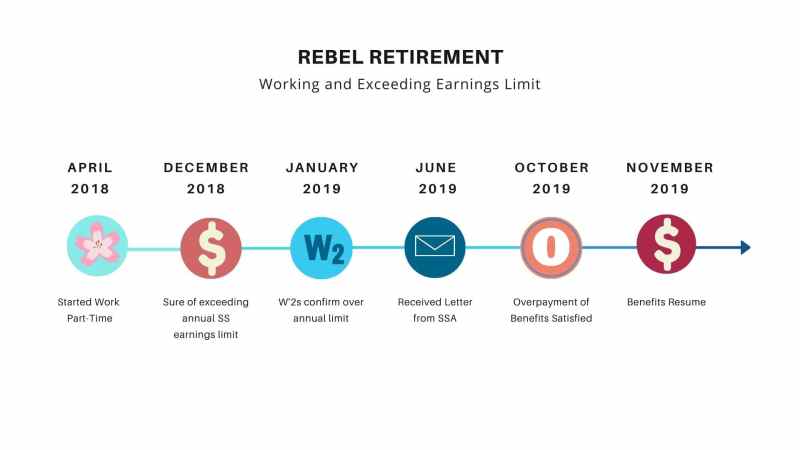

Rebel Retiree began collecting benefits at 62. In the second quarter of 2018, he started working part-time and anticipated his wages would be more than the annual earnings limit by the end of the year.

He was unsure of the duration of his job, or whether he would quit before reaching the earnings limit. With that in mind, he chose not to inform Social Security in advance.

Instead of notifying Social Security in advance, he decided to play it by ear, go with the flow, and let the chips fall where they may.

Exceeding the Annual Earnings Limit for Social Security

By the end of the year, his earnings exceeded the annual allowable limit. The following January, his W2s confirmed it.

At that time, we didn’t know how it would be resolved.

I understand that facing something unfamiliar can be overwhelming, especially when dealing with bureaucratic agencies like the Social Security Administration.

Although Social Security’s website is easily accessible and provides in-depth explanations, there are numerous rules and regulations to digest. This can cause confusion and unease.

As someone who has gone through this experience, I’ve written this article hoping to provide useful insights. I hope you find it helpful.

Don’t Worry if You Exceed the Social Security Earnings Limit

You are not alone. Many people fear punishment or penalty by the Social Security Administration for exceeding the earnings limit.

In light of that, here’s an interesting story. Recently, a member of a Facebook group for retirees shared her experience of taking early Social Security benefits before full retirement age.

She was working and had exceeded the yearly earnings limit. Even after contacting her local Social Security office, she felt more confused than before. She reached out to the group for help.

Typical Concerns of Earning Over the Social Security Earnings Limit

The story continues. The woman asked if anyone in the group had any personal experience with this situation.

She worried about:

- Penalties

- How to return the money

- Do you pay the money back directly

- Do you need to write a check to the Social Security Administration

- When will benefits resume after SSA withholds the overpayments

A few people replied:

- Someone recommended that she rethink her situation and suspend her benefits until her full retirement age

- Another quoted the Social Security Administration

- People shared links to confusing articles

People tried to be helpful, while others treated her like she had made a mistake in collecting earlier instead of later.

Read: Should I Take Social Security at 62, or Wait? Do the Math

After reading her responses to their answers, I deduced she found them unsatisfactory. At that point, I realized I could assist her and shared my experience.

Based on her reply, I’m confident she found my information useful.

Next, I’ll explain what happens if you work, collect social security benefits, and earn over the annual earnings limit.

Despite common belief, it’s not as complicated as it may seem.

Now What? I’m Over the Annual Social Security Earnings Limit

So, what happens after you’ve earned over the limit?

You don’t have to do anything in advance if you work while collecting benefits and expect to exceed the annual earnings limit.

Note: The Social Security Administration wants you to advise them in advance. However, that isn’t always practical for various reasons.

Note: You will not be penalized or pay extra for waiting until you are certain how your particular circumstances develop. That said, we’re not advising that you intentionally withhold information about your earnings.

When Social Security receives your W-2s and tax returns, they will evaluate your account and make adjustments based on the information provided.

For detailed information, see this article on SocialSecurityAdministration.gov.

Let me say that the Social Security Administration will only contact you by official mail through the United States Postal Service. Unless you initiate phone or email communication, they will never call or email. Having said that, please understand that all of the examples I share come from communications by mail.

Read: How Will Social Security Contact Me?

How Do You Pay Back Social Security if You Make Too Much Money?

Approximately 6 months after filing our joint tax return for 2018 which claimed earnings from Rebel Retiree’s part-time job, he received a letter from the Social Security Administration.

The letter explained that work and earnings caused an overpayment in benefits. It thoroughly explained the amount of overpayment. Plus, it showed the amount that must be repaid to Social Security.

It stated that X amount of dollars from the September 2019 payment would be withheld in October to recover the overpayment.

As in all tax-related judgments, the letter informed Rebel Retiree of his right to appeal. It also stated his right to request a waiver if:

- The overpayment was not his fault in any way

- He could not meet living expenses if they recovered the overpayment

- If recovery would be unfair for some other reason

All of the figures were accurate and he had no reason to appeal.

We did not pay out of pocket in advance. We waited for benefits to be withheld.

The overpayment in benefits was satisfied, and regular Social Security benefits returned the following month, in November.

Trust the efficiency of the Social Security Administration

Don’t let the fear of making more than the annual earnings limit stop you from working and claiming your Social Security benefits concurrently. There are perks to doing so.

As long as you continue to work and collect benefits, the Social Security Administration will check your records annually to see whether your additional earnings will increase your benefit amount.

Yes! That’s correct.

Continuing to earn and contribute to your account may increase your benefits.

However, Social Security has a formula to determine this. And it all depends on your highest-earning years. So, it doesn’t necessarily mean your benefit amount will increase, but it’s possible.

It’s all based on your lifetime contributions. And you know best your circumstances regarding that.

If there is an increase, they will mail you a letter telling you of the new benefit amount.

Additionally, when you reach your full retirement age, they will recalculate your benefit amount and give you credit for any months you didn’t receive a payment because of earnings! It should be noted that the amount will not be in one lump sum, but will be included in your monthly benefit amount.

Conclusion

Exceeding the Social Security yearly earnings limit while working can be worrisome – especially if you are unfamiliar with the process. However, the SSA is very efficient in managing overpayment of claims.

- You are not charged a penalty

- You do not have to write any checks to Social Security to pay them back unless you want to

- Benefits resume the month after they’ve withheld benefits due to overpayment. This is over time depending on your situation.

- After you reach full retirement age, they recalculate your benefit amount to give you credit for any months you did not receive a benefit because of your earnings.

Last updated for clarity: 04/10/24

Related Articles You May Like:

- Is it Better to Take Social Security at 62 or Wait

- I’m a Homemaker-Can I Collect Social Security Benefits if I’ve Never Worked

Do you have experience with this situation? Please feel free to comment below! And before you go, please take a moment to subscribe to our newsletter, and like us on Facebook!

While it is requested and advisable to inform the SSA of changes to and anticipated yearly income, my understanding (especially based on your excellent blog) is that is not a mandated requirement. This is specific to retirement benefits, not SSI, disability or other programs. I’ve exceeded the 12 month window to rescind my SSA retirement, just recently turned 63 and had the opportunity to reengage a previous employer with a high salaried role in June. I’ve already received 7 months of retirement payments of about 17K. If I don’t inform SSA, the total overpayment through 2024 will be 29K. Understanding a portion (up to 85%) will be factored into my taxable income for 2024, and considering my employment will likely extend at least through 2025, how will payback of over payment be managed? I’m assuming payments will be withheld due to anticipated earnings in 2025, once my W2 is processed in 2025. Will the pay back withholding start once retirement payments are resumed, either as a result of my no longer working or reaching FRA? While I am making a decent salary, I’m not planning on writing a check for repayment, either for the 19K already paid or potentially 29K if I choose not to inform SSA directly. And of course, I will be paying back into SSA during this employment run. I hope this makes sense and appreciate any additional insights.

Hello Don,

Good question! If they stop payments because of your earnings, benefits resume when you become eligible. That could be because of reduced income, you no longer work, or you’ve reached FRA. Keep in mind your individual circumstances. You may need to communicate this to them. I wrote my article based on personal experience. That said, here’s a link to Social Security’s Code of Federal Regulations that explains penalties for failure to report. https://www.ssa.gov/OP_Home/cfr20/404/404-0453.htm It sounds like you’ve taken advantage of a wonderful opportunity! Remember to check the earnings limit when you reach FRA. In 2024, it’s $59,520 without affecting benefits. I hope this helps. Thank you for your positive comment about the blog. Good luck!

Thanks for the link. Makes for interesting reading and consideration. The referenced Federal Regulation Code ( 404.452. Reports to Social Security Administration of earnings; wages; net earnings from self-employment.) indicates the requirement to report, under clause 3, to avoid any “penalty” assessed and due for failure to report, support the timely submission based on W-2 submission and tax filing. Specifically “An income tax return or form W-2, filed timely with the Internal Revenue Service, may serve as the report required to be filed under the provisions of this section, where the income tax return or form W-2 shows the same wages and/or net earnings from self-employment that must be reported to us.” Interesting. Will digest further and let marinate but good info.

Happy to know you found the info useful. We tend to be assertive with decisions of this nature. Best of luck in whatever you decide to do.

Marlene,

Yoga Woman

I read the “EN-05-10069.pdf” document explaining how benefits are reduced if you earn too much. In their example, a person retires at age 62 and is eligible for $910/month ($10,920 per year). Assume that that they earn so much every year that all benefits are withheld (a total of $54,600 for five years). At age 67, they give you monthly $910 + $390 (the $390 is repayment for the withheld money). At this rate, it would take SS between 11 and 12 years to pay back the $54,600. Is this math correct?

Hi Joe, You’re right. Your math is correct. Social Security does not repay in one lump sum. Therefore, it would take 11 to 12 years to recoup the withheld money. Collecting benefits at 62 may not be the best option for high wage earners. However, it’s a good choice for many who retire at 62 and work part-time, or have other income not counted as earned income for the purposes of the SS earnings limit. Please remember that prior to FRA, Social Security withholds $1 for every $2 over the earnings limit. In year of full retirement, it’s $1 for every $3. For someone reaching FRA in 2024, the annual earnings limit is $59,520. Steve Votaw’s gives an excellent example of how earning well over the limit works for him. Please check out his comment if you haven’t already done so. Hope this helps you figure out your best course of action.

Best,

Marlene, Yoga Woman

I retired at 63 and my FRA was 66.5 years old. I began collecting social security 38 months before FRA, and accepted that there would be a penalty based on those 38 early payments I was taking before FRA. But I went back and consulted part time several months later, and exceeded the allowable income limit. It was during COVID and I did go to the SSA office to discuss but they were not open to visitors, and I failed to write a letter advising them. When they figured it out, they required me to send them a check for about $30k to refund benefits I should not have received, and they suspended future benefits for about another year. So even though I took my first benefit check 38 months early, I really only collected 14 months of benefit before reaching my FRA. I reapplied when I reached FRA, and I’ve been collecting, but I’m still getting the 38 month reduced rate, and have not gotten the $30k back. Shouldn’t I get a higher rate, as if I only retire 14 months early, instead of 38?

Hi Jeff, Social Security reviews your records and recalculates annually. They will refigure and repay you any increase that’s due. Benefits are paid in December of the following year. You will not get the $30K back in one lump sum. However, it will be recalculated and spread out over the remaining years that you continue to receive benefits. Check out this PDF from Social Security, How Work Affects Your Benefits: https://www.ssa.gov/pubs/EN-05-10069.pdf

Best,

Marlene, Yoga Woman

This is the most helpful article I have read regarding exceeding SS limits for earnings. My job was updated one year for a restructuring project, and the following year they added a raise for years of service. I have been there 25 years so that was another big raise, and now my title changed, and I received another raise. I have more than doubled my income in the last three years causing me to go over the limit now and also will continue until I completely retire so this is amazing information and much appreciated to explain details regarding the unknown that I was concerned about. Now I know what to expect and plan for. Thank you so much!

You’re welcome, Mara! Thanks for taking the time to share your thoughts. I’m happy you found this article helpful. Sending much appreciation and best wishes for a happy and healthy future!

Best,

Marlene, Yoga Woman

Thank you for clearing up the confusion about this! I started collecting my Social Security last year at age 63, and wish I would have done it as soon as I was eligible at 62. Friends and relatives thought I had lost my mind. But when you do the math, it only makes sense. I am still working, and one of the things I’ve heard over and over is that I’ll have to pay the SSA back if I earn more than the cap. They don’t seem to understand that you don’t have to write them a huge check. I haven’t gone over, and don’t expect to, but your post confirms that it’s not something I need to worry about.

Hi Liz,

Yes! It’s a common theme to be told not to take Social Security at the earliest opportunity. I’m so happy to hear that you thought this through and made the right decision for you. Thank you so much for sharing your thoughts. It helps us get the message out as well as giving readers the opportunity to collect valuable information from others.

All the best,

Marlene, Yoga Woman

Hey fellow retirees,

I started collecting at 62 1/2 and it’s great . I still work full time and make about the same amount of SS I receive over the limit . About 20k . So they take about half of it back each year . I still get about a 10k raise from the SS that I receive. It will be only 6 checks a year roughly but that’s fine with me . After all it’s my money . This year I won’t get a check until September but that’s okay . I will use that money to pay off any debts I have . It’s a win win if you want to keep working . In my opinion .

Thank you, Steve! Your testimonial will help countless others understand the benefits and perks of collecting SS at 62.

All the best,

Marlene, Yoga Woman

The more i read on the SS site the more confused I become.

Spouse and I both started receiving SS Jan 1, 2024. However both I retirements got pushed back till the end of Feb. So we made well over the monthly minimum for Jan and Feb, and because of paid out vacations March also. But we are under the yearly total. Not sure if we will owe the three months payments back.???? Reading the SS site I kind of see it both ways. Help please.

Hi David, The Social Security Administration website provides a wealth of information, but it can be so confusing! Unless things have changed, you are subject to an annual earnings limit, not monthly. Therefore, as long as you don’t go over the annual earnings limit, you’re fine. I’m wondering if SS tells it both ways because they think it makes it simpler to break it down into monthly limits. I think it makes it more complicated and confusing. I hope you and your wife enjoy a wonderful retirement!

Best,

Marlene, Yoga Woman

There are a lot of people out there who do not receive a lot in SS and are eligible for other benefits, such as their part B,of their Medicare; Medicaid to supplement what Medicare doesn’t pay, like dental; property tax breaks, HEAP, etc. That is something else to take into consideration if you go over the limit. Granted, at that point most could probably start paying that themselves, but it kind of defeats the purpose of working which is to make a little extra to live a better life. They’ll still be hanging by a thread though this time even more indebted. The government has to stop penalizing people for trying to succeed. We should be trying to raise boats, to paraphrase JFK, not sink them.

Hello Anna, Thanks so much for making this point. It is definitely worth emphasizing.

Best,

Marlene, Yoga Woman

Hello, I am confused and can’t seem to get anywhere at the SS office due to long waits. I want to retire this year at 62, and I understand I won’t get the full benefit. What I am trying to find out is if I make more then the annual allowed with my part-time job, will they deduct that up front or at the back end. How does that work?

Hi Terry,

If you’re uncertain about what your annual earnings will be, Social Security will deduct at the back end, meaning after they receive your W2s. The repayment will affect the subsequent year’s monthly benefit amount. Once the repayment has been satisfied, benefits resume. Or you could tell them how much you’ll earn in advance and they will adjust the benefit amount on the front end.

Best,

Marlene, Yoga Woman

I am working full time but I want to stop working once I start receiving SS, which will be in February. I am at full requirement age of 66.6 months. I will be getting a little over 18,000 yearly. It says I cannot go over the amount of 25,000. Does that mean I can make up to 25k in addition to SS or does it mean in a combined amount with SS? This has got me confused. I have read a lot about this but, it still does not give me a direct answer what is right. Can you please explain to me?

Hello! I have good news for you. At full retirement age, you can collect benefits and earn as much as you want without it affecting your Social Security benefits. I don’t know your personal circumstances, but please keep it mind, you may owe income taxes depending on your tax bracket and the state in which you live.

Furthermore, to answer your other question, the amount you can earn is in addition to your Social Security benefits. So let’s say your benefits are $18,000 a year. If you are under FRA, for 2024, you can earn $23,230 in addition to your benefits. That’s a total of $25,030. In year of full retirement, you can earn $59,520 without affecting benefits. At FRA, earn as much as you want.

Again, because you are at FRA, you can earn as much as you want! I hope this clears up a few things for you. Thanks for stopping by and wishing you a great retirement!

Best,

Marlene, Yoga Woman

I had to start collecting Social Security at age 62 because of a job loss. I am divorced, but had been married for 18 years prior to the divorce. I was first told by Social Security that I could not collect on my ex-husband’s benefits. That was corrected. Two years later when I called Social Security and inquired about that. They could only back up the benefits for six months. I am currently working full-time and Social Security taxes are being taken out. I will be 72 this year with them, taking out Social Security taxes, does that mean that my Social Security benefits are still increasing? I know I have to call them and find out what my benefits are now they may be higher than half of his my question even though I am still working on my benefits increase in yearly?

Hi Mary,

Great question! Even though your employer is taking out taxes for Social Security, your benefit amount may or may not be increasing. May or may not is because Social Security calculates benefit amounts based on your highest 35 earning years. For example, if your latest year of earnings turns out to be one of your highest, Social Security should automatically recalculate your benefit amount and pay you any increase that’s due. Here’s the SS Retirement Ready Over 70 Fact Sheet that gives more details. Hope I’m been able to help.

All the Best,

Marlene, Yoga Woman

I am one year beyond full retirement and still working part time. If I were to start collecting my SS benefits and continued working would my benefit amount be recalculated at 70 yrs of age. Or because I am already at full retirement age would the amount stay the same as when collected. Most of the questions are addressing those who collect before their full retirement age. My circumstance is somewhat different. Or is it more beneficial to not collect until 70 years of age .

My age 67 and 4 months.

Hi Vince,

Good question! Social Security reviews your records annually. If your latest year of earnings is one of your highest years, Social Security will recalculate your benefit and pay you any increase you are due. Therefore, if you continue working and your earnings are one of your highest earning years, your benefit should increase at 70. Of course, I don’t know your retirement goals, but it is our opinion that waiting until 70 could cost you. Here’s a link to another article explaining that logic: /is_it_better_to_take_social_security_at_62_or_wait/

Best,

Marlene, Yoga Woman

What will happen to my wife’s SSA benefit when we separate in 2023. She (born in 1960) started receiving in Dec 2022 at age 62. I was born in 1956 and I am at full retirement age and she will start drawing SSA based on my SSA benefit. If we separate and she start receiving 50% of my military retirement pay and alimony payments will that affect her SSA benefits? She will have then have two sources of new income plus her SSA benefit. So, how will this affect her SSA benefit??? Yes, she will soon be bringing in over the threshold limits, either in the 2023 tax year or the 2024 tax year???

I was let go from a job that I had been on for 12 years in September of 2020. This was completely unexpected. I had just bought a new manufactured home in August of 2020. I was 63 and in the middle of a pandemic, I was panicking big time!! Would I be able to find a job at my age and in the middle of a pandemic? How was I going to pay my bills?!! I am single and had been for 10 years at that time and still am. Just me and no other income at all. Also, I had borrowed from my 401 K to get this house. So I went ahead and filed for SS. I was able to find a full-time job, which I started in March of 2021 making less money, but it was something and with my SS I could at least pay my bills. Now this month I received the dreaded letter from SS that they had paid me too much because I earned 22640.00 in 2021, so they paid me 1839.00 too much. My question is, they are saying that they paid me 30818.90 for January 2021 through Feb 2023. Why are they counting all of these months to show that they overpaid me for my 2021 earnings? Shouldn’t they just be counting what they paid me in 2021? I don’t understand.

Hi Marsha,

Ah! I’m so glad the pandemic years are behind us. I’d have to read the letter, but from what you’ve described, I think they are saying this based on anticipated earnings for 2022 going into 2023. When you earned over the earnings limit in 2021, they assumed you would continue working and earning at the same rate. If your situation has changed, or you are not making as much, let them know. This should all work out at full retirement when they recalculate your benefit amount which will include your current wages. You sound like a real trooper. All the best to you moving forward.

Best,

Marlene, Yoga Woman

I called SS office 3 times last year. First letting them know that I would make over the amount. I am full commission but will make at least 80k to 100k plus. I asked them what to do about my benefits I received. I was told not to worry about it and I would just have to pay taxes. Okay so I was satisfied. Later on in the year I said I am going to make way over the amount so how does the tax situation apply. No worry we send you your statement. So I thought okay, I have to pay taxes anyway so no big deal. However, just did my taxes and moved me into another tax bracket. I owe $19k in taxes. I called SS in Feb of 23 and said I can not keep receiving benefits. I tried to quit them last year and they said just pay the taxes. No mention of repayment of the SS amount. So I owe $22k overpayment. And if I was given the correct information this never would of happened as well as I had a year to rescind my request which I was not told when I called in Nov. and my year was up Dec. 22. I never get the same information. I feel with the misinformation at best rescind my application. If I have to pay this back fine but it certainly will be in installments. I plan on working until the retirement age at minimum. I only took the benefits at the time due to health reason and was not earning any income.

Hi Debra,

It sounds like you did everything you could to apprise SS of your anticipated earnings. I’m sorry to hear that you received such conflicting information from them. Rest assured, you are not the only one with that complaint. If it’s any consolation, at least the benefits were there when you needed them. Best of luck moving forward. And thank you so much for sharing your story. I’m sure there are others in this community who will find it beneficial.

Best,

Marlene, Yoga Woman

Hi, I applied for my SS after being laid off during COVID, I was 64 then (2021). I worked part-time last year (2022) and left it for a full-time position making over the threshold for 2022. I called SS to inform them of how much I thought I would be over and I had them to suspend my payments so I wouldn’t owe a lot of money. I will reach full retirement age in March 2023. I have checked to see if my income for 2022 has been updated, however, I only see the income for the part-time position. My question is, will they readjust what I owe once they get my income from the full-time job for 2022? They are still collecting the overage amount from 2022 until it is paid back, which I told them is more than what I actually went over.

Hi Renee!

If SS hasn’t already made the adjustment based on your telling them that you earned less than anticipated, they should readjust when they receive your tax return for 2022. You may also be able to move the process along a bit faster if the loss in benefits is causing financial hardship.

Thank you for sharing with this community. We all have unique situations, and your comment helps us all.

Good luck!

Best,

Marlene, Yoga Woman

Greetings, I will be 63 in July of 2023 I make around 60,000 a year. If I started collecting SS in July 2023 as I understand it I would be penalized for earning more. So I guess i would not be receiving a check at some point. But would It all build up till full retirement? and I would receive more than the normal monthly payment? Is this how it would work: I start to receive a check in september (waiting month of August) then they check my income and stop payment the following year (2024) is this correct? So I do not have to pay the money back I just stop receiving a check?

Hi Mark!

The earnings limit for 2023 is $21,240. If you earn more than that by July, I don’t think there is any point in collecting. But, yes, if you continue to work, it all builds up and you receive a higher monthly payment at FR. And, yes, if you start to receive a check and then SS checks your income on your tax return and it is over the earnings limit, they will start withholding benefits until the overage is met. You do not have to pay the money back, you just stop receiving a check. Hope this helps you make your decision. Good luck!

Best,

Marlene, Yoga Woman

Are you aware that if you go over the amount that is allowed for working $21,240 for 2023. You are then subject to having your benefits taxed anywhere from 50% – 85% depending on how much you are over and your filing status. Which is money you owe IRS. Not only that but the overage in your benefits that Social Security will take from your benefits the next year if you don’t tell them and you just keep collecting your benefits. Is this accurate from what I checked out with taxing your SS Benefits and the IRS Notice 703 regarding taxing of SS Benefits. Could you please clarify this for me. If I take another job as mine is being eliminated I will be over the amount I am allowed and based on my calculations I will owe SS almost $6900 based on every $2 they take $1 and the IRS for taxing my SS Benefits at 50% for my total income amount almost $6,000. Would this be correct.

Hi Deb!

I am aware that Social Security benefits may be taxed if you have substantial income in addition to your benefits. Any time a person collects SS benefits and earns over the annual earnings limit, they are subject to adjustments made in their benefit amount and taxes that may be owed. Please check with Social Security or an accountant. If you cannot pay the taxes, you may be able to make a hardship claim and pay over time.

All the best,

Marlene, Yoga Woman

I retired early in mid 2022 , ( not to mature age yet, ) and started working part time for the same company, every year they give out profit sharing for employees, and since I worked the whole year of 2022, half full time, half part time, can I except the profit sharing for the year 2022, and if I do, does that count against my income for the year, and will I have to pay back money since I am collecting S.S. I feel I have earned the profit sharing. So what should I do. Please let me know. Thanks

Hi JJ!

Congratulations on your recent retirement! Your employer would be the best option for answering questions about profit sharing. Although, to my knowledge, profit sharing is considered earnings/income. In that case, it would count toward the earnings limit. However, if the profit sharing is applied in 2023, then the earnings are for 2023. You don’t actually have to pay the money back to SS. They withhold benefits until the amount over the earnings limit is satisfied. Then benefits resume. Try contacting the Social Security Administration. They should be able to clarify this for you. Perhaps someone on this comment thread is familiar with this situation and will let us know. Hope this works out well for you!

Best,

Marlene, Yoga Woman

It depends on how profit-sharing plan is structured. My previous company deposited the yearly profit sharing payment into the company pension. After leaving the company I rolled over the funds from the pension into an IRA. Therefore profit sharing was never taxed and won’t be until I eventually make withdrawals from my Rollover IRA …

Thank you for this invaluable information, Robert.

I am retired collecting social security and 62 I do not reach full retirement until I’m 67. I have been offered a position that would put me over the current max salary allowed by SS before a 401K contribution. This job offers a 401k plan, and I would put the max of $30k into it annually. Subtracting my 401K contribution that would make my take home salary less than the SS threshold of income. Does my 401k contribution get counted as income by SS if it goes into a 401k account?

Hi Frank!

This sounds like a great opportunity! This is a decision you’ll have to factor in, but SS does count an employee’s contribution to a pension or retirement plan as income. Follow this link to Social Security’s booklet “How Work Affects Your Benefits”. Scroll to page 4, What Income Counts, and When We Do Count it. Remember if you continue to work, your contributions will likely increase your benefit amount at full retirement.

Hope this helps! Good luck!

Best,

Marlene, Yoga Woman

Hi,

I am 64 and work part time and collect Social Security. In October I went over the yearly amount of income allowed. I called Social Security and the man asked how much I expected to make for the year. I am a server and it varies, I told him I may make $22,00.00 for the year. That being about $2,500 over the annual limit. He said because I had informed them now they would take the overpayment of penalty of $1,250.oo out of my next Social Security Check. I told him that was terrible as I had not made all that money yet and did not feel I should penalized prior to earning the money. How can they penalize me for money I have yet to make. He said I would get a letter . I wish I had never called. Sounds like if you do not call they wait till the end of the year to view your income. Calling and being up front now means over the holidays I will have almost no social security to live on. I guess being honest and up front is not what to do.

Help !

Meg

Hi Meg,

Wish I had better news for you. But once you’ve contacted Social Security about expected earnings, I don’t think you have much recourse. We recommend staying silent because nobody really knows if, or how much, they will earn over the limit for the year. It’s only an expectation. At any rate, Social Security finds out how much you’ve earned when you file your taxes. Then, they make the adjustments to benefits. We’re simply recommending kicking the can down the road a bit. Social Security will get the money, regardless. If it’s a hardship for you at this time, you may be able to address that when you receive the letter from them. Here’s a heads-up. They will likely adjust future benefit amounts for 2023 based on 2022. If you won’t be earning as much, let them know.

Withholding your benefits is a bummer, but it’s not a penalty. There’s an earnings limit and we can only make so much before it affects our benefits. Take heart that this extra money applies to your account and will be returned in higher benefit amounts at full retirement.

I think you’re taking a great approach by collecting benefits and also working. Let those benefits work for you! /is_it_better_to_take_social_security_at_62_or_wait/

Thank you so much for sharing your experience with us. It really helps out our other readers. I hope your holidays are merry despite this little blip.

Best,

Marlene, Yoga Woman

Hi I applied for social security in November 2021 . I’m 62 and have other income other than my job . It is a rental income . I was told that does not apply hopefully ! My job I’m still there part time , because my check will not come until January . My question is how will social know if I’ll be over my earnings limit ? I won’t be ,but just curious do they monitor it monthly or yearly ? Because this month I may be over a bit thank you for any help can’t get much help on the phone

Hi Kim!

Your rental property doesn’t count as income for purposes of the earnings limit. In our experience, Social Security monitors annually, based on your tax return. I haven’t heard anything otherwise. As a heads up to you, I will say that if you happen to go over the earnings limit they may want to adjust your benefits in the subsequent year, expecting you’ll make the same amount of money. That happened to my husband (after writing this article). However, his situation had changed. He would not earn the same amount of money. Nor would he earn over the annual earnings limit. He notified Social Security, explained his situation, and they corrected the benefit amount. We prefer to take a wait-and-see attitude. Then, be proactive in our dealings with SS. Hope this helps.

All the best!

Marlene, Yoga Woman

Thank you !

Guess what I will be going over the limit . I will call them next week it’s impossible not to go over the limit . I need my health insurance I had to stay on till end of year 🙁

Hi Kim!

I’m sure it will all work out for you. Wishing you all the best!

~Marlene

One last question I love your blog too !! So helpful . I applied in November 2021 got check January 2022 so how do I calculate my earning from when to when ? Nov to nov or Jan to Jan thank you !!!

Hi! So happy to be of help! To my knowledge, your earnings are calculated on a calendar basis. There is a special rule for the first year of collecting benefits. This PDF from Social Security may be helpful. https://www.ssa.gov/pubs/EN-05-10069.pdf

~Marlene

I found this article very helpful! I do have a question for my husband who is self employed. He is 63 and considering taking his early SS payments but we are not sure if the income limit would be based on his gross income or his net income annually once all of the write offs are calculated. Do you happen to know? Thank you!

Hi Beth,

That’s a great question! And the news is good! If you’re self-employed, Social Security counts only your net earnings from self-employment. Your husband’s write-offs will reduce his gross income. This link will take you to a Social Security PDF. Scroll to page 5, 2nd sentence.

Thank you so much for stopping by. I’m happy you found this article helpful!

All the best,

Marlene, Yoga Woman

Hello, I just turned 63, born in 1958, FRA is 66 and 8 months. I would like to work until 70 to get the extra 30% on my benefits. I work abroad with a tax free income status of just over 100K., even though my total income is higher. After my FRA, can I can still earn my total income (over the 100K) without any tax penalty? I read you could, but am not sure.

Hi Paul,

Unfortunately, I’m not familiar with working abroad and how that affects SS benefits and tax status. Perhaps the links below will point you in the right direction.

Thanks for stopping by.

Good luck!

Marlene

https://www.ssa.gov/benefits/retirement/planner/taxes.html

https://www.irs.gov/businesses/the-taxation-of-foreign-pension-and-annuity-distributions

Thank you for this. Excellent article!

Although, I have been told a different story by several people from the Social Security office. I called several times, because , it is ludicrous.

They told me that the gov. does NOT deduct what you go over, from your next SS check.

Instead, they take the whole check!

SO, if you go over $100, they take it all!

Then split up the difference for the duration of our lifetime checks. I figured it would be about a raise of about 0.50$.

In your letter, they just deducted it, and you got the rest of it. Right away.

I wonder if this new and improved rule, started last year. I have another year to go.

Do you have any incite on this? Great website!

Hi Mary!

Wish I could be more helpful, but I’m a bit confused as to why Social Security told you that they would take your whole check, unless the full amount is what would be needed to repay an overpayment of benefits. They do spread out your money over time when they owe you and they recalculate benefit amounts – meaning they don’t give you one lump sum. Dealing with these people can be so frustrating at times! Perhaps this is a new rule as you said. I’m so happy you found this article useful.

Thanks so much and all the best for a happy retirement,

Marlene

I talked to my accountant (Illinois) and told him that I was put on full commission (so I will now make to much money)after I had applied for SS. he said hold out a dollar for every dollar over to pay back to SS. Question: do I keep half my overpayments or do they want it all?

Hi David!

I’m happy to answer this question for you. Social Security will expect any and all amounts that you’ve earned over the annual earnings limit to be repaid. When requested, you may want to pay it back yourself. Hence, your accountant’s advice to hold out a dollar for every dollar you earn. We prefer to take a wait-and-see attitude. When Social Security notified us of an overpayment of benefits, David took the option to have Social Security withhold benefits until they recovered the money that was overpaid. After that was fulfilled, his benefits resumed.

Thanks for stopping by!

Best,

Marlene, Yoga Woman

I started receiving benefits in August and will continue working until December. How does SS determine the amount of the overage I will earn. Do they look at individual months since I was not collecting all year or does the total annual income count?

Hi Ed,

From our experience, Social Security counts income on an annual basis. However, they have special rules for those who start collecting mid-year and have already earned over the annual allowable earnings limit. Here’s a link to Social Security’s Special Earnings Limit Rule. that explains what happens if you retire mid-year.

This article, Receiving Benefits While Working may also be helpful.

All the best,

Marlene, Yoga Woman

Hi Mary, I have had this happen every year since I began receiving survivor benefits in 2017. They suspend full checks never just what I owe. I just work a part time job and I am under fra. One year they withheld 3 full benefit checks for no reason, because by my figures I only owed them less that 700. I have only been “paid” back in June twice. In 2019 they sent me a $7.00 and in 2021 a big improvement, they refunded me $650.00. Now in 2022 I will not receive my check for February. This makes it difficult for a lone widow to buy food and pay bills. Everything I read online says they should only withhold the 1.00 for every 2.00 earned and it should say we will only withhold full checks if you go over earnings test. My situation has not been fair at all. I am dissappointed, but still thankful for the benefit. When I do fully retire I will be hit with the Government pension offset and the windfall elimination provision. Then my benefit will be permanently reduced by two thirds or possibly wiped out completely. I feel a bleak future is in store for my situation and many others. I hope it improves for us all

I retired at 62 and I have been receiving SS since June 2020. I am considering going back to work at a lower salary that I used to make before I retired at the beginning of 2022. Salary will be +/- $60,000 a year. This will obviously be way over (40K) the $18,960 limit for 2022 and 2023 even if they increase it by a few hundred each year. I cannot suspend my benefits anymore I am passed the 12 month timeframe and I don’t have the money to repay what I already got. I am sure my benefit will be withheld for 2022 and 2023 as I plan to work till I am 65. My question is will the SSA withhold my benefit until every dollar in excess of the limits for 2022 and 2023 are repaid? If yes, this means I will not receive payments for both years and perhaps a few months after I retire again?

If you’re collecting benefits and have been paid too much, Social Security will notify you of the overpayment. If you agree, monthly SS benefits will be withheld until the overage is paid. How long depends on your particular circumstance. So, yes, it’s possible you will not receive payments for both years. Perhaps this PDF from Social Security will be helpful. https://www.ssa.gov/pubs/EN-05-10098.pdf

Thanks for stopping by!

Best,

Marlene, Yoga Woman

Hi Billy!

Wow! You’ve got quite a few questions. Unfortunately, I am unable to answer all of them for you. The purpose of this article is to give an honest evaluation of our experience with exceeding the SS earnings limit. It’s meant to inspire and give courage to those who are afraid they will be penalized if they work and collect benefits. We’ve found the Social Security Administration to be efficient in its methods for calculating and disbursing benefits. And if you continue to work and collect benefits, the Social Security Administration will check your records annually to see whether your additional earnings will increase your benefit amount at FRA. However, that increase will be in the form of an increased benefit amount, not one lump sum.

Your best option is to contact Social Security directly with your questions about disability. That’s not our area of expertise.

Our mission at Rebel Retirement is to write positive and empowering articles to inspire others to retire without worrying about the money. We don’t give financial advice.

Here are a couple of links to SS that I hope will be helpful How Work Affects Your Benefits, Benefits for People With Disabilities

Thanks so much for stopping by!

Good luck, Marlene

Once you retire early, are your locked into that amount for the rest of your life minus COLA or could it be changed at some point? My amount is very low, however, I don’t want to wait due to illness. Also can SS penalize and punish you for earning more than the allotted amount if you work, I need the health insurance, I’m just turning 62?

Hi Gayle!

Once you retire at 62 and collect SS benefits, you are locked into that amount unless you continue to work. If you continue to work, your employer will deduct Social Security taxes from your paycheck which will be applied to your account. In turn, this increases your credits. Then, when you reach your full retirement age, Social Security recalculates your benefit amount to reflect the years that you worked after you began collecting at 62. You could get a higher payment. No guarantees, however. That depends on your personal set of circumstances as to what’s in your account.

However, there’s no way around the earnings limit. If you collect benefits at 62, you will be subject to the annual earnings limit.

This probably isn’t feasible, but is it possible for you to arrange part-time work with your employer to stay within the limit and still receive some kind of health insurance?

It’s a shame health care is so expensive! I wish my answer was more positive. Take care of yourself!

All the best,

Marlene

If you read my annual SS statement we should all receive, it states “In other words, if you would like to work and earn more than the exempt amount, you should know that it would not, ON AVERAGE, reduce the total value of lifetime benefits you receive. My question is do you get the amount of benefits withheld all at once at full retirement age?Or do they divide them up over several years? Thanks, Rich

Hi Rich!

What a great question! I wish I could say that Social Security repays those benefits immediately at full retirement age. However, you won’t get the funds in one lump sum. Your monthly benefit amount will be increased, meaning you will get the money back over time. Here’s how SS states that it works. “Your benefit will increase at your full retirement age to account for benefits withheld due to earlier earnings.” Hope this answered your question. Thanks for stopping by!

Best, Marlene

I’m wondering about a scenario in which someone might earn well in excess of their SS benefit. Is it possible the whole SS benefit might be withheld, and if so, would the SS benefit increase as if it hadn’t been taken until later in life. For example, to preserve the approximate 8% per year increase.

Hi Doug!

If someone earns well in excess of the SS earnings limit, I think it’s possible that the whole SS benefit may be withheld in a subsequent year. That’s because whatever was paid out over the earnings limit must be repaid. However, SS does adjust benefit amounts based on highest year’s earnings. Each individual circumstance is different. Therefore, I can’t say whether or not it would match the 8% per year increase if one waits to collect. Here’s a link to Social Security which describes how earnings affect benefits. Our mission is to encourage people to collect early and invest in themselves.

Best,

Marlene, Yoga Woman

I enjoyed this article. I know the Earnings Cap for 2021 is $18,960. I am turning 65; laid off earlier in 2021; collecting unemployment, not collecting social security. If I take a job and contribute to my 401k plan, does Social Security calculate your earned income minus contribution? Let’s say I was earning $40,000 and contributed 10,000 to a plan would SS say my earned income was 40K or 30K? Or does SS have a rule that says you can’t do this to lower income so as not to exceed Earnings Cap?

Hello Pam!

That’s a great question! Social Security counts your gross income before contributions. Therefore, if you earn $40,000 and contribute $10,000 to your 401K plan, they calculate your income at 40K. Check out page 4 of this PDF from the SSA on how work affects your benefits. It explains what income counts and when they count it. Thanks so much for stopping by! Hope this helps. Good luck!

Best,

Marlene